Corporate Governance

Leading with integrity

Our corporate governance includes the bylaws, policies, and practices used to oversee the business and affairs of the Credit Union Deposit Guarantee Corporation.

Our Board

of Directors

Appointed by Alberta’s Lieutenant Governor, our independent Board of Directors is comprised of up to seven engaged Albertans who responsibly advance the long-term interests of our stakeholders. Operating within a strategic governance model, they are responsible for the stewardship of our corporation in compliance with the Credit Union Act.

Meet our

Board of

Directors

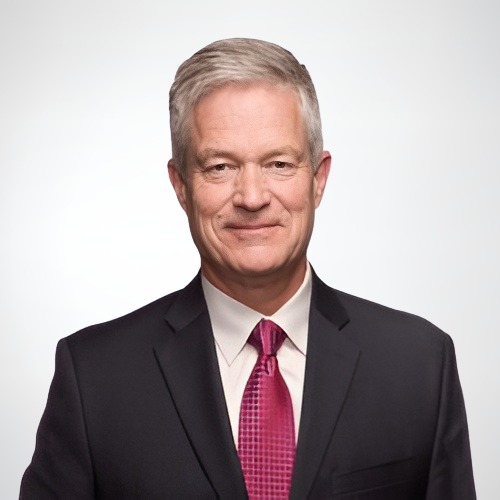

Ken Morris, ACUIC

Ken was appointed as Chair of the Board of Directors on November 7, 2024 and brings nearly 40 years of experience in the financial services industry. Thirty-four of those years were in management positions within the Credit Union System.

The roles Ken held include President & Chief Executive Officer of Encompass Credit Union/Wainwright (15 years), Board member with Alberta Central, member of the Celero Solutions Inc. Management Committee, Chair of the Alberta Credit Union Managers Association, and Chair of the Northern Region of Alberta Credit Unions. He also served on the Board of Concentra Financial which is now part of Equitable Bank.

Ken graduated with honours from the Credit Union Institute of Canada Management Studies Program with a specialty in lending, is a graduate of the Credit Union Director Achievement Program, and received his leadership certificate through the Queen’s Leadership Program.

Ken resides in Wainwright where he enjoys spending time with his spouse, children and numerous grandchildren.

Laurene Beloin, MBA, ICD.D

Laurene is the incoming Chair of the Governance & Human Resources Committee and outgoing Chair of the Audit & Finance Committee. She offers a demonstrated history of working in higher education, and has banking, finance, credit union and pension industry experience where she is currently the Director of Client Relations and Communications.

Her roles in various industries allow her to bring skills to the Board such as operations management, business expansion, entrepreneurship, leadership, corporate training, and project management with a focus on change management and stakeholder relations.

Laurene graduated from the University of Toronto with a Certificate in Risk Management. She also has an MBA degree, and an ICD.D designation from the Institute of Corporate Directors, Rotman School of Management.

Camille Bérubé, FCUIC, ICD.D

Camille is an appointed nominee of the Board of Directors from the Alberta Credit Union System. He is currently a co-owner of a consulting firm. Prior to being self-employed he was the Chief Executive Officer of the Beaumont Credit Union where he gained experience in finance, strategic planning, management consulting and board governance. Camille also brings 20 years of municipal government experience to the Board, having served as Mayor of Beaumont for 16 years.

Camille has a Bachelor of Arts from the University of Alberta and holds a designation as a Fellow of the Credit Union Institute of Canada (FCUIC). He holds an ICD.D from the Institute of Corporate Directors, Rotman School of Management.

Harrison MR Clark, J.D, B.Comm, BA

Harrison is an Alberta-based corporate lawyer with deep expertise in financial services. With a focus on due diligence and analysis, he brings several years of experience in regulatory compliance, governance, risk management and corporate transactions.

Recognized by the Canadian legal profession, Best Lawyers: Ones to WatchTM in Canada, Harrison exemplifies the expertise and dedication required to tackle the complexities of today’s legal environment. He is an active member of his community and has held Corporate Associate positions at law firms in both Calgary and Edmonton.

Harrison studied at the University of Saskatchewan, and holds a J.D., B.Comm. (Dean’s Honour Roll), and B.A.(with Distinction) in Political Studies. He is a member of the Law Society of Alberta and the Canadian Bar Association.

Harpreet Kohli, CISM, CISA, CISSP

Harpreet is a cybersecurity executive, board member, speaker, and coach. She currently serves as the Associate Vice President of Identity and Access Management (IAM) at Cooperators, one of Canada’s leading multiline insurance companies.

Harpreet brings decades of expertise in security and technology leadership and has extensive experience in building and optimizing cybersecurity programs within highly regulated industries, including utilities and financial services. In her current role, she oversees the IAM function and leads efforts to protect Cooperators' information and technology assets while influencing the company’s investment in security innovation.

Harpreet also serves on the board of directors at Concordia University of Edmonton as a member of the Risk and Audit Committee and the Finance committee.

Beyond her corporate contributions, Harpreet coaches technology and cybersecurity leaders on O'Reilly, a leading North American media and training platform. She is also a regular speaker at conferences, addressing cybersecurity topics relevant to executives and leaders, helping them navigate the evolving landscape of Artificial Intelligence and increasingly stringent data protection and privacy laws.

Harpreet holds several globally recognized security certifications. She has a Master’s in Electronics and Communication Engineering from India and a Master of Information Systems Security Management from Canada.

John Lamb, ICD.D, CCD

John is an appointed nominee of the Board of Directors on behalf of the Alberta credit union system. He is a respected community leader who retired from his position as Deputy Fire Chief of Operations at the City of Edmonton in 2014.

John’s involvement with cooperative governance began over 30 years ago, as Chair of the Edmonton Firefighters Credit Union. He has represented credit unions in the North and Central regions of Alberta as a director of Alberta Central and served as Vice Chair of The Cooperators Insurance Group of Companies. In 2005, John was one of the founding directors of the Alberta Community and Co-operative Association and served as a director of Cooperators Development Corporation Limited. He recently completed a ten-year term on Servus Credit Union’s board of directors.

John is experienced in strategic planning, policy development, communication, and emergency response. In addition to completing several executive leadership and business certification programs, he is a Credit Union Director Achievement (CUDA) program graduate, holds an ICD.D designation and is a Certified Credit Union Director (CCD) through the CUES Governance Leadership Institute.

Rita Virk, MPAcc, CPA, CA, ICD.D

Rita has extensive experience in financial reporting and analysis, risk management, policy development, and internal audit. She practices in a wide range of industry sectors, including financial institutions, insurance, biotechnology, transportation, and technology.

Rita brings over ten years of board experience, most recently as a member of the Departmental Audit Committee, Department of Innovation, Science, and Economic Development Canada and as a member of the BC Real Estate Association. Prior to the 2020 merger of Prospera and Westminster Savings credit unions, Rita had the opportunity to serve on two special purpose committees dedicated to overseeing merger-related activities. Post-merger, she was the Audit Committee Chair, and a member of the People Experience Committee.

Rita is passionate about learning, innovation, and emerging technologies. She studied at the University of Calgary and University of Saskatchewan prior to obtaining her CPA designation. She holds an ICD.D designation from the Institute of Corporate Directors, Rotman School of Management, has participated in the Ivey Business School Leadership Program and is a member of the Harvard Business Review Advisory Council.

Key governance practices

The Board of Directors and its committees operate under formal Terms of Reference that align with the expectations of the President of Treasury Board, Minister of Finance.

The Board’s key responsibilities are agreed upon with the Minister and fall into five high-level areas. Workplans define the activities the Board and its committees will undertake to carry out the following:

Strategy and direction setting

- Set bylaws governing the business and affairs of the Corporation.

- Hold an annual strategic planning session to direct the development of a budget and business plan.

- Establish the Fund size and set the assessment rates charged to credit unions.

Succession planning

- Approve CEO selection, performance evaluation, termination, succession planning and compensation.

Oversight and enterprise risk management

- Oversee the implementation of an enterprise risk management framework.

- Approve and monitor policies.

- Review system update reports to ensure oversight of the risks in Alberta credit unions and Alberta Central.

- Approve the annual report.

Governance system effectiveness

- Administer the review and renewal of the Mandate and Roles document every three years.

- Delegate powers, duties, and functions as appropriate.

Our Executive Team

Meet the dedicated individuals at the helm of the Credit Union Deposit Guarantee Corporation.

Our executive team is composed of seasoned professionals with a deep understanding of Alberta’s financial sector. Their leadership and strategic guidance are essential to enabling a safe and sound credit union system in Alberta.

Meet our Executive Team

Joel Borlé, MBA, FICB, ICD.D President and CEO

Joel was appointed President and Chief Executive Officer in August 2020 for a six-year term. With over thirty years in the banking and financial services industry, Joel brings extensive knowledge and leadership experience to the role.

Throughout his career, Joel has focused on building strong connections and professional relationships. Prior to joining the Corporation in 2007, he held roles at Bank of Montreal and ATB Financial. With experience in commercial and retail lending, strategic planning, credit and sales operations, information technology, and project management, Joel was well suited to lead the Corporation’s Regulation and Risk Assessment and Business Services and Regulatory Practices teams before succeeding to his current role.

Joel holds an MBA from Dalhousie University and bachelor’s degrees in science and commerce from the University of Alberta. He is a Fellow of the Institute of Canadian Bankers, a certified Project Management Professional and holds an ICD.D designation from the Institute of Corporate Directors.

Jammi Rao, FRM, ICD.D Vice President of Business Services, Risk & Regulatory Practices

Jammi has primary responsibility for establishing standards of sound business practices and managing enterprise and information technology risks. He joined the Corporation in 2013, bringing considerable knowledge and practical experience in managing credit and market risks.

Throughout his 40+ year career, Jammi has lived and worked in four different countries. He gained experience in retail banking, commercial lending, asset-liability management, investments, and treasury and capital markets through roles at Alberta Investment Management Corporation, TD Canada Trust, and Kuwait International Bank.

Jammi is highly educated with multiple degrees focused on statistics, mathematics, physics, and economics. He holds a MS from Nagpur University, India. Jammi is a certified FRM professional and holds an ICD.D designation from the Institute of Corporate Directors.

Jammi is a former board member of Goodwill Industries of Alberta and a current member of CIVIDA (formerly Capital Regional Housing).

Peter Baba, CFA Vice President of Regulation & Risk Assessment

Peter Baba leads a team of credit and regulatory risk assessment specialists who monitor and direct the business practices of the Alberta credit union system to enable safety and soundness.

Peter joined the Corporation in January 2021 with over 33 years of experience in the financial services industry. He has a strong background in regulatory oversight and prudential supervision, balanced by practical experience in banking operations, lending, treasury and finance.

Prior to joining the Corporation, Peter spent eight years with the Government of Alberta as the Deputy Superintendent, Financial Institutions, Regulation. In this role he was responsible for overseeing the financial institutions regulated by the Province of Alberta.

Peter is a CFA® Charter holder and has a bachelor’s degree in economics and a business certificate from the University of Alberta.

Erin Stephen, CPA, CAVice President of Finance & Administration

Erin provides leadership in establishing policies and programs to cost-effectively manage Alberta’s credit union deposit guarantee fund.

Erin joined the Corporation in May 2023 with 25 years of leadership experience in financial services. Since 2015, Erin has worked directly with federal and provincial regulated financial institutions in roles at PwC, ATB Financial and Canadian Western Bank. She leads performance driven teams to achieve innovation in strategy and governance, enterprise risk management, liquidity management, finance, and internal audit. Prior to working with financial institutions, Erin was responsible for the financial reporting groups at a large Alberta municipality and a publicly traded potash company.

Erin holds a CPA, CA designation and was a 2020 recipient of CPA Alberta’s Distinguished Service Award. Erin is passionate about public service and is currently serving as a public audit committee member of an Alberta school board and a financial advisor to the Alberta Urban and Northern Aboriginal Head Start program. She is a past president and youth director of her local Rotary Club.

Governance documents

Our corporate governance practices begin with our Board of Directors and are brought to life through our culture, policies, and practices.

We believe in transparency and accountability. That’s why the information below is available to our public stakeholders.